Complex made Easy

Intelli-Select extracts business complexity out of your processes handling financial securities in order to manage them in an easy & intuitive way

Our approach

Complex problems are often solved with complex software solutions requiring precision in interaction & programming to get results.

Our solution introduces an intuitive dialogue between the business user and the software within a knowledge module, representing, for example, financial securities with INVEST

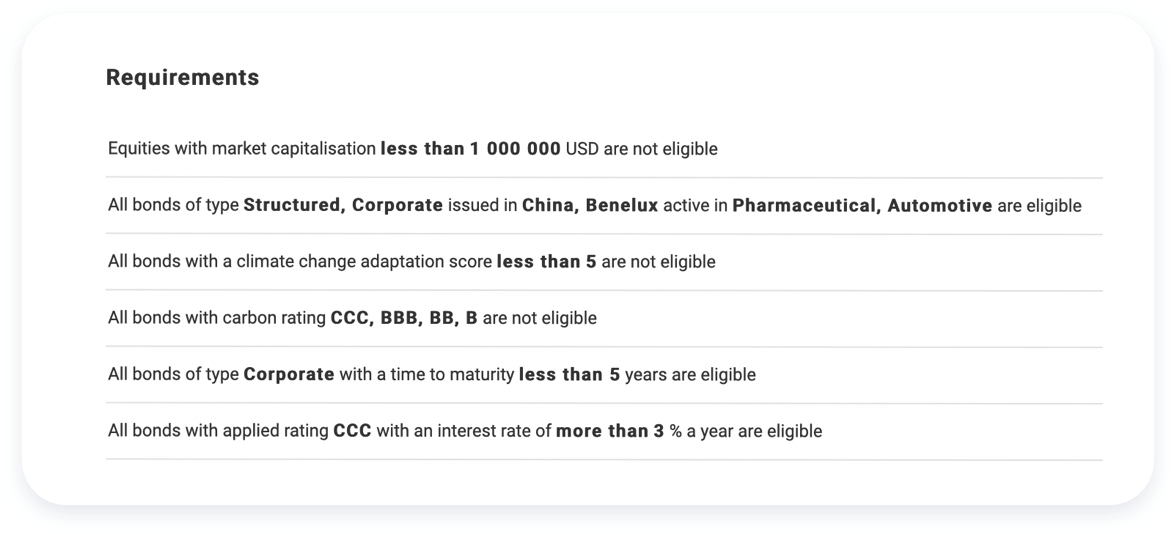

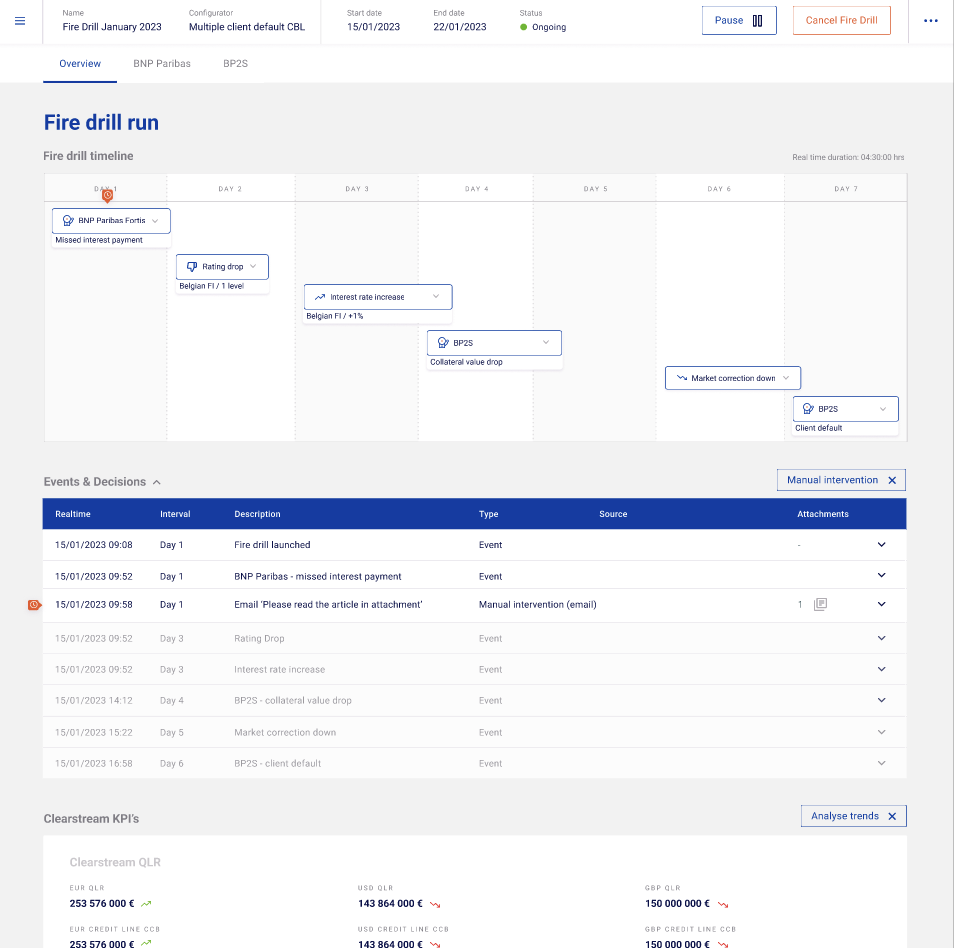

COLLAT: Collateral Contract Manager

PREDICT: Credit Event & Default Simulator

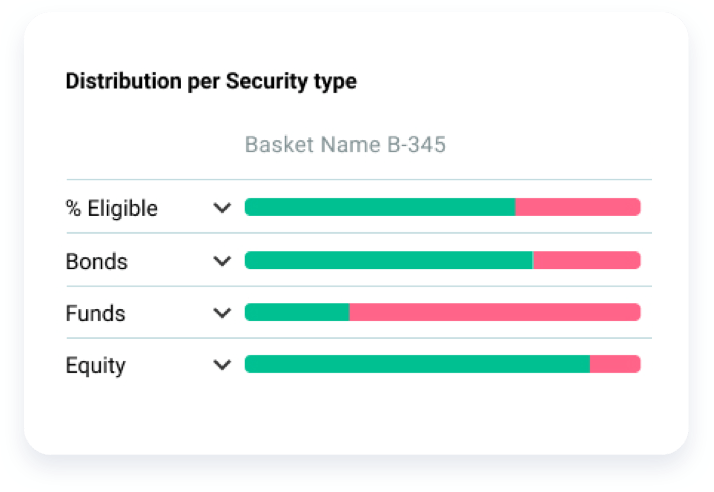

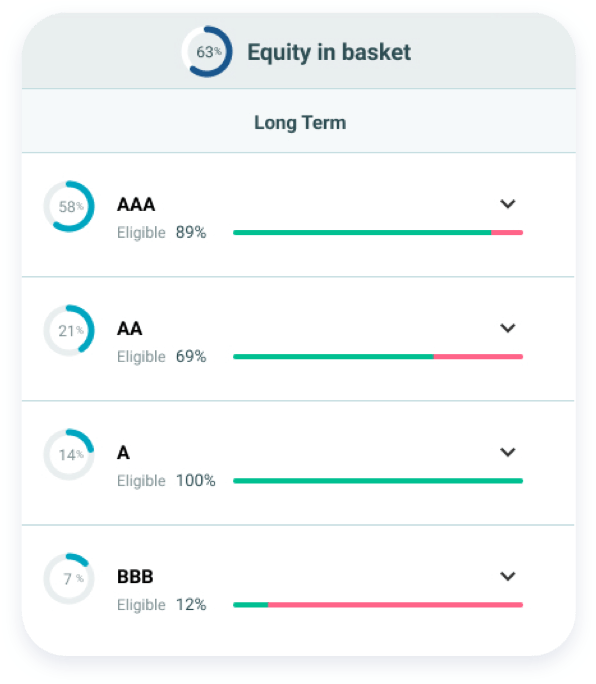

INVEST: Portfolio Insight Management

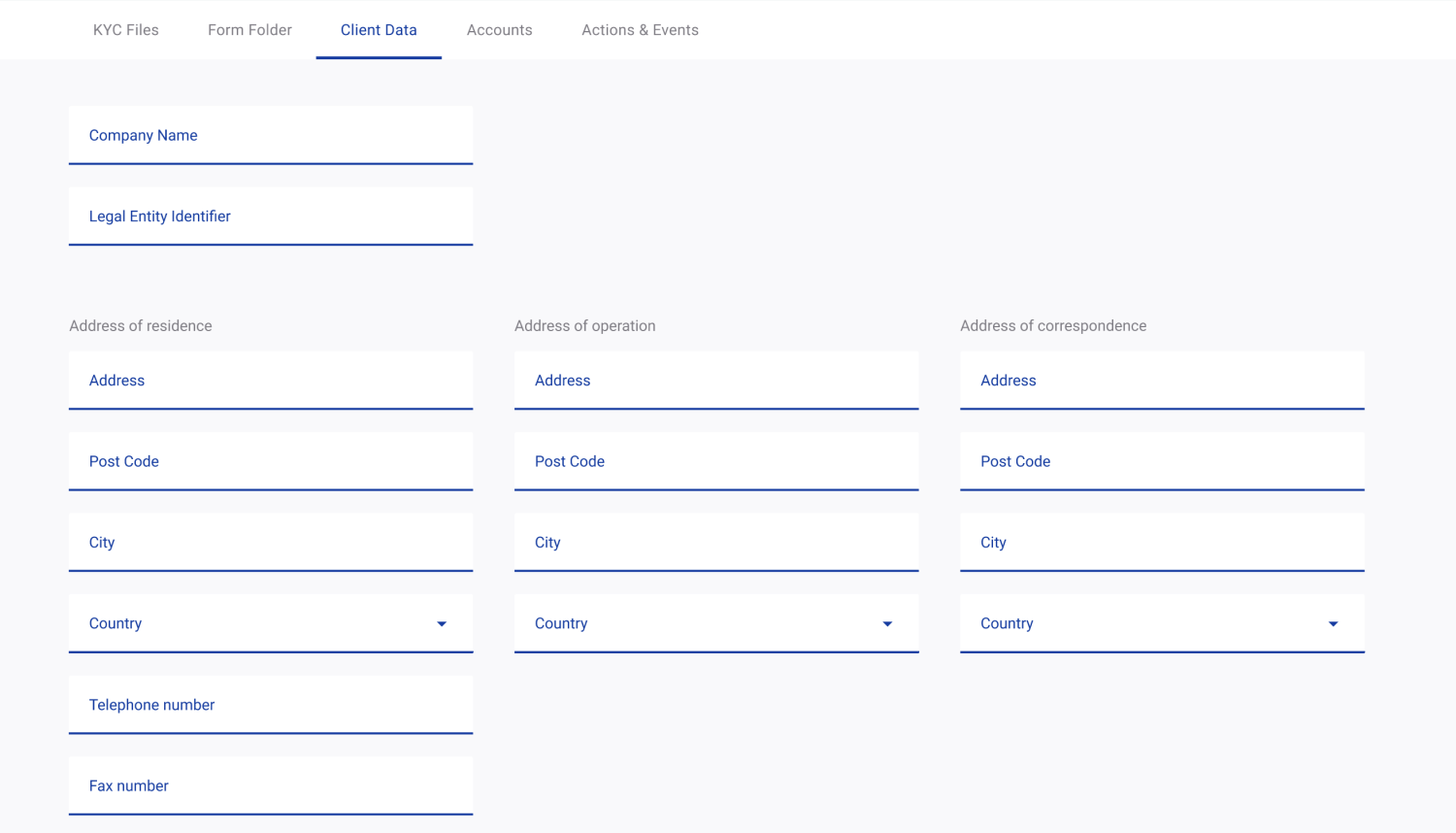

SCRIBE: Filling out contracts & forms

Use cases

Applications

How can Intelli-Select help you?

Our knowledge and approach can solve many problems when dealing with complex domains and datasets: like calculators, decision engines, selection automation and so on. We’re looking forward to your challenge!

Online calculators

Interactive forms containing input values with a high degree of interdependence. The Knowledge Module in the background guarantees consistency of values and adherence to relationships and constraints.

It keeps track of remaining possible values and explains the reason “why?”.

Smart contracts

Structured natural language drives the user interface, allowing for the creation of complex parts of contracts (e.g. financial securities, investment prospectuses, etc).

The Knowledge Module reflects on the sentence and the context, highlighting logical inconsistencies and providing new insights on the fly.

Think-bot engines

Not just a chat-bot, but a think-bot!

The integration of natural language and the confirmation of its understanding of your question, allows for the Knowledge Module to drive the data analysis in the background and reply in natural language.

The intuitively smart think-bot.

About us

Intelli-Select is a Fintech creating highly innovative business solutions; combining knowledge articulation & knowledge acquisition expertise with IT delivery skills, geared to unlocking the potential of artificial intelligence into real-world solutions.

We work with a highly skilled team of domain experts both IT, Business and Data Science resulting in solutions far better than any of its components.

Our knowledge and approach can solve many problems when dealing with complex domains and datasets.

The team

- Bart CoppensChief Business & People Enabler – Co-founder

- Nuno ComendaChief Technology & R&D Enabler – Co-founder

- Diane NolanChief Strategy & Sales Enabler